Image: Hollywood (Wikipedia)

Image: Hollywood (Wikipedia)

Author: VANAS

Major Boost to California’s Film & TV Tax Credits

Table of Contents

- Overview of the Tax Credit Increase

- Why the Increase is Necessary

- How the Tax Credits Work

- Comparison with Other States

- The Impact on the Industry

- Frequently Asked Questions

California Governor Gavin Newsom has recently announced a significant boost to the state’s film and TV tax credits, aiming to reinvigorate Hollywood's production landscape. This decision marks a crucial turning point for the film industry in California, which has faced numerous challenges in recent years.

Overview of the Tax Credit Increase

Governor Newsom's plan intends to raise California's film and TV tax credits from $330 million to an impressive $750 million annually. This increase is still pending approval from the Democratic majority legislature in California's 2025-2026 budget. The announcement, made at Raleigh Studios, aims to inspire confidence within the local industry, which has experienced a drastic reduction in production levels and job opportunities.

Mayor of Los Angeles, Karen Bass, joined Newsom in this announcement, emphasizing the need for enhanced tax credits to combat the decline in production. The film industry in L.A. has seen a noticeable drop in activity, with reports showing a significant decrease in production work throughout 2023.

Why the Increase is Necessary

The need for this substantial increase stems from several factors. For one, the current tax credits system is outdated and oversubscribed. An industry insider noted, "So many productions don’t even apply because there is such a slim chance they’ll be successful." The criteria and offerings in the current program do not meet the needs of today’s industry, which has evolved dramatically over the past decade.

The previous tax credit system established in 2014 primarily focused on job creation and attracting productions from other regions. However, as competition from states like Georgia and New York has intensified, California’s offerings need a serious upgrade.

Despite the existing economic challenges, the film and TV tax credit program has proven beneficial for California's economy. According to a report from the Los Angeles Economic Development Corporation, "for every tax credit dollar allocated, the state benefitted from at least $24.40 in economic output." These figures demonstrate the immense value that a thriving film industry can bring to the state.

How the Tax Credits Work

Under the current tax credit program, California offers a 20-25% tax credit for studio films, independent films, new TV series, and relocating shows. The anticipated increase in the budget will not introduce new categories or percentages; rather, it will make the existing funds more accessible for potential applicants.

Currently, there is a limited pool of available credits. For instance, $132 million is allocated annually for new TV series and pilots, while $115.5 million is designated for feature films. The vast majority of funds are already claimed by established productions, leaving newcomers at a disadvantage.

With the increase in available tax credits, the hope is that more projects will be able to secure funding, leading to a rise in production and job opportunities in California. As Newsom stated, the expectation is that the revitalized program will be perceived as more accessible than ever.

Comparison with Other States

California is facing stiff competition from other states that are enhancing their own tax incentives to attract film productions. For instance, Georgia boasts an uncapped incentive program with a budget between $900 million and $1.2 billion annually. Productions filming in Georgia receive a 20% base transferable tax credit, and they can earn an additional 10% if they include the state logo in their credits.

New York, which previously increased its incentives to around $700 million, is also a significant competitor. While California maintains the highest production levels overall, the financial allure of other states cannot be ignored.

The ongoing competition has prompted states to adjust their tax credit offerings frequently. As states like Georgia and Louisiana continue to attract big-budget productions with lower costs and enticing incentives, California must remain proactive to keep Hollywood at the forefront of the industry.

The Impact on the Industry

The anticipated changes to California's film and TV tax credit program are expected to revitalize the industry significantly. Many in Hollywood have felt the sting of decreased production opportunities over the past year. The increase in tax credits may lead to the creation of new jobs and boost local economies across California.

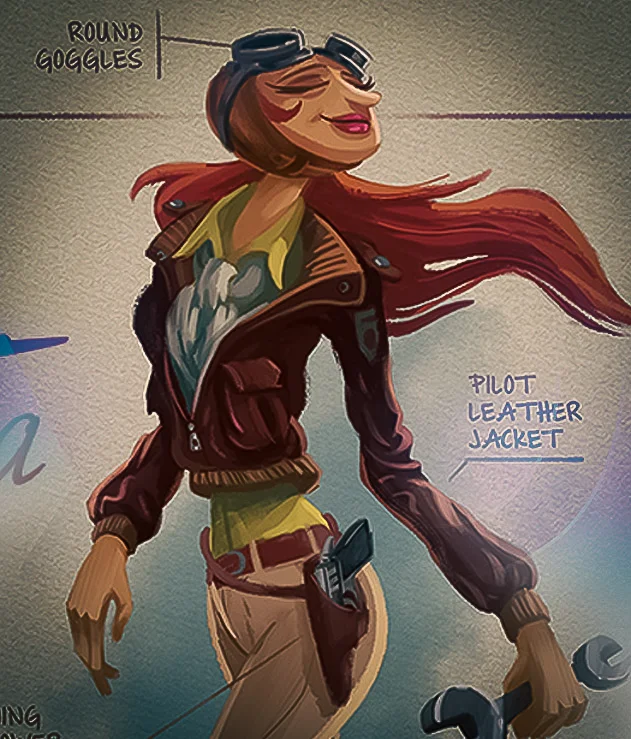

With increased funding, more productions could choose to film in California, benefiting not just the state’s economy but also aspiring filmmakers and artists. "A robust film industry opens doors for many different careers," says an industry expert. "From animation to visual effects, there are countless opportunities for creative minds."

VANAS Online Animation School offers Animation, Visual Effects, and Video Game programs, making it an ideal place for aspiring artists and animators to launch their careers. By visiting VANAS, students can explore how they can contribute to this revitalized industry.

Frequently Asked Questions

What are tax credits in the film industry?

- Tax credits are financial incentives that reduce the amount of tax a production company must pay. They encourage filmmakers to choose specific locations for their projects.

Why is California raising its tax credits?

- California is raising its tax credits to make the state more competitive with other regions and to boost the local film industry, which has seen a decline in production.

How do tax credits benefit the economy?

- Tax credits stimulate local economies by attracting film productions that create jobs and generate revenue through spending in various sectors, such as hospitality and services.

Will the increase in tax credits attract more productions?

- Yes, with more funding available, the hope is that more projects will apply and secure the necessary resources to film in California.

What should aspiring filmmakers know about this announcement?

- Aspiring filmmakers should understand that increased tax credits could mean more opportunities for funding and production in California, leading to a healthier film industry overall.

VANAS Online Animation School offers Animation, Visual Effects, and Video Game programs, providing the skills necessary for students to thrive in this exciting industry. To launch your career, visit VANAS.

As California's film industry braces for potential changes, the excitement around this tax credit increase signifies a renewed hope for aspiring filmmakers, animators, and creative professionals. With a supportive environment and ample opportunities, now is the time to get involved in the world of Animation!